Introduction

Although there are many stocks that one may invest in, there is a defined category of stocks known as blue-chip stocks, which have been particularly known for their reputations and stability with promising growth over the long run. So, what are, blue-chip stocks and why do investors care about them? How do they add value to the investment portfolio?

What Are Blue-Chip Stocks?

Blue-chip stocks, for their part, refer to the stocks of huge established and sound companies that have submitted a track record of stability in their share performance. They are usually industry leaders with stable earnings, solid brand names, and stable dividends. The term “blue chip” originated from poker, where the blue chip was the highest denomination in a poker game; the same is true for the value of blue chip stocks—high reliability.

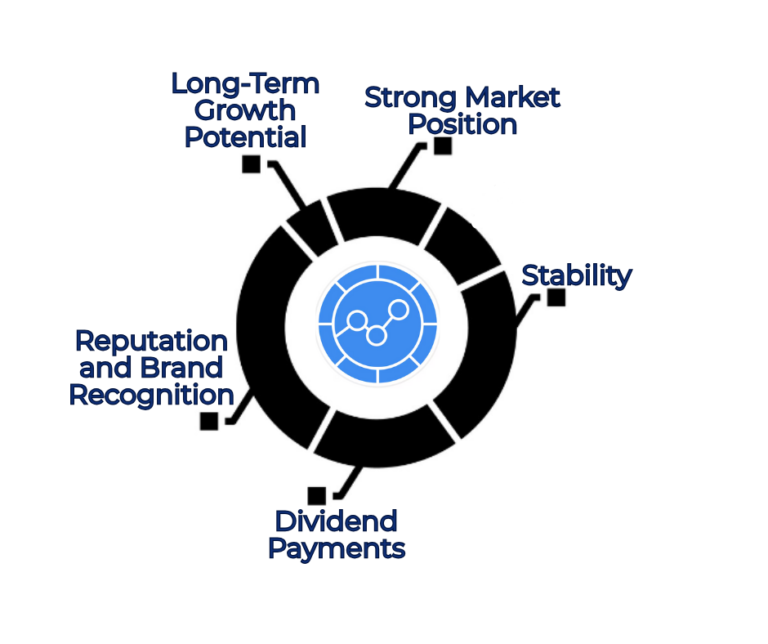

Characteristics of Blue-Chip Stocks

Some of the major points that distinguish blue-chip stocks from others are some notable characteristics. A few of these main differences have been noted below:

- Stability: These companies have remained stable in their financial performance as well as even in the economy.

- Strong Market Position: They are industry leaders, offering something critical or indispensable.

- Reputation and Brand Recognition: You would know right away if a namesake company were the Johnson & Johnson or Disney firm—about as trustworthy worldwide as a name can get.

- Dividend Payments: Most of the blue-chip stocks pay consistent dividends, thus emerging as attractive investment tools for income-conscious investors.

- Long-Term Growth Potential: They may not be as fast-growing companies as startups, but they oftentimes provide steady, reliable returns over the long term.

Why Blue-Chip Stocks Matter to Investors

The value that investments in blue-chip stocks have is provided by stability in a portfolio. Here is why they matter:

- Reduces the Risk of an Investment: Blue-chip stocks tend to be less volatile than other shares, thereby making them ideal for conservative investors.

- Diversification Benefits: They balance a portfolio and reduce overall risk as they act as a stabilizing influence during market downturns.

- Reliability: These equities can generate capital appreciation along with dividend yield over time, which further compounds into long-term growth.

- Economically Resilient: Many of the blue-chip firms belong to less economically cycle-sensitive industries, including the consumer goods and healthcare industries.

Examples of Top Blue-Chip Stocks

Among the most famous blue-chip stocks that have a stable performance are the following:

- Apple Inc. (AAPL): Apple’s innovation and loyal customers provide adequate protection for the stock’s value.

- Microsoft Corporation (MSFT) : A general technology company with a diversified business model from cloud-based services to software.

- Coca-Cola Co. (KO): It is pretty much a yesteryear name in the consumer goods space and is by definition global.

- Johnson & Johnson (JNJ): Healthcare Industry Leader.

- Procter & Gamble Co. (PG): For household brands and dividend yield reliability.

Pros and Cons of Investing in Blue-Chip Stocks

Pros:

- Lower Volatility: The price fluctuation of blue-chip stocks is lesser.

- Dividend Yield: Most blue-chip stocks pay dividends, which leads to stable dividend income.

- Long-Term Reliability: Blue-chip stocks come with a reputation and stability. This means they are less likely to lose value in the long run.

Cons:

- Limited Upside: Compared to the smaller growth stocks, capital gains from blue-chip stocks are relatively low.

- High Price per Share: Many blue-chip stocks are pricey, which makes them out of the league for small investors.

- Sensitive to market sentiment: When there are downturns in the economy, not even blue-chip stocks are safe from erosion. However, they rebound quickly.

How to Invest in Blue-Chip Stocks

Under the blue-chip stocks, investment can be done in a couple of ways, such as follows:

- Direct Purchase: Purchase of shares directly through a brokerage account.

- Exchange Traded Funds (ETFs): Most ETFs are exclusively aimed toward blue-chip stocks that can be diversified without necessarily having to buy individual shares.

- Dividend Reinvestment Plans: Some companies offer DRIPs through which an investor is given the option of investing their accrued dividend in more shares that may eventually compound returns over time.

- Mutual Funds: Although not all, most mutual funds that tend to have a high concentration of blue chips are large-cap or value stock funds.

Final Thoughts on Blue-Chip Stocks

Blue-chip stocks are the product of direct choice and are a favorite investment destination both for inexperienced and seasoned investors. These are good enough for a well-diversified portfolio and, therefore, help the novice investor as he or she ventures into stocks without being very sure about the outcome. These are stable in nature, offer consistent returns, and generate yield. They do not explode like crazy, but they are really very reliable and pretty sound in uncertain economic times.

Conclusion

Blue-chip stocks are excellent investments for any individual who is looking for long-term security and a reasonable return rate. Though they certainly are not the smartest investment, their history has proven to be of extreme value in the long run to create wealth and ensure a steady flow of revenue, even in times of economic volatility.

FAQs

Can Blue-Chip Stocks Lose Value?

- Yes, blue-chip stocks can lose value, especially during broader market downturns or economic recessions. However, because of their stable financial positions and established market presence, blue-chip stocks are more likely to recover over time, making them more resilient than many other stocks.

Are Blue-Chip Stocks Suitable for Beginners?

- Yes, blue-chip stocks are often recommended for beginners because of their stability and reputation. They offer a more conservative entry into the stock market and can serve as a solid foundation for a diversified portfolio, providing long-term growth potential with lower risk.

Are Blue-Chip Stocks Expensive?

Blue-chip stocks can have high share prices due to their established reputation and market value, which may be a barrier for some investors. However, fractional shares, ETFs, or mutual funds allow investors to invest in blue-chip companies with smaller amounts, making them more accessible.

Owner of Paisewaise

I’m a friendly finance expert who helps people manage money wisely. I explain budgeting, earning, and investing in a clear, easy-to-understand way.

Pingback: 10 Ways to Invest in the U.S. Market - Paisewaise

Pingback: 10 Ways to Invest in the US Market - Paisewaise

Pingback: What Are Some Common Myths About Dividend Stocks? - Paisewaise

What an amazing post! Your research on this topic is very impressive and your style is very engaging. Keep up the amazing work!

I could tell the author has put in a lot of thought and effort, it shows.