Introduction

It is daunting if not having much money to invest at the onset. Be it $100, $1,000, or $10,000, knowing your investment options will allow you to maximize your returns given an acceptable risk level. We will discuss each investment amount strategy, its approximate return, and pros and cons of each.

How to Invest $100

The starting point should be with $100, where one can look for very cheap investment opportunities that would possibly grow. Here are some of the top ways of making that first $100 work for you.

1. Micro-Investing Apps

Overview:

Micro-investing platforms like Acorns, Robinhood, and Stash allow investing small sums of money into equities, ETFs, or index funds. Some applications also offer the round-up feature; you can have your spare change put towards investments.

- Average Returns: Depending on the app and your portfolio, expect returns of 5-8% annually, based on historical stock market data.

- Pros: It’s easy to use, low entry point, and automated investing features.

- Cons: Monthly fees can “eat into small investments,” and no control over specific investments.

2. Robo-Advisors

Overview:

Robo-investors, such as Betterment or Wealthfront, enable you to put money into a diversified portfolio with minimal input. It allocates funds based on risk through algorithms.

- Average Returns: Around 5-7% per annum, depending on the market and portfolio type chosen.

- Pros: Cheap management fees, diversification, no hands to manage.

- Cons: Minimum personalization may well influence the charge on even the smaller investment.

3. High-Yield Savings Accounts or CDs

Overview:

The high-yield savings accounts and certificates of deposit can be considered to gain safe interest on the deposited funds. These are safe in nature but provide returns relatively less than the returns achieved by investment in the stock market.

- Average Returns: 1-2% Annually.

- Pros: It is FDIC-insured, easy to access, and no risk is implied.

- Cons: The lack of return is relatively lower as compared to other investments.

How to Invest $1,000

You can get invested with $1,000, with more options and a greater chance to begin to think about slightly higher-risk investments for potentially greater returns.

1. Exchange-Traded Funds (ETFs)

Overview:

ETFs provides access to all kinds of stocks, bonds, or commodities and is typically well-diversified and very cost-effective. One can find sector-specific ETFs within the technology or healthcare sector or more general product tracking indexes.

- Average Returns: Historically, sometimes 7-10% per annum, as are the returns from stock markets.

- Pros: Diversification, low fees, high liquidity.

- Cons: Market risk; some have management fees.

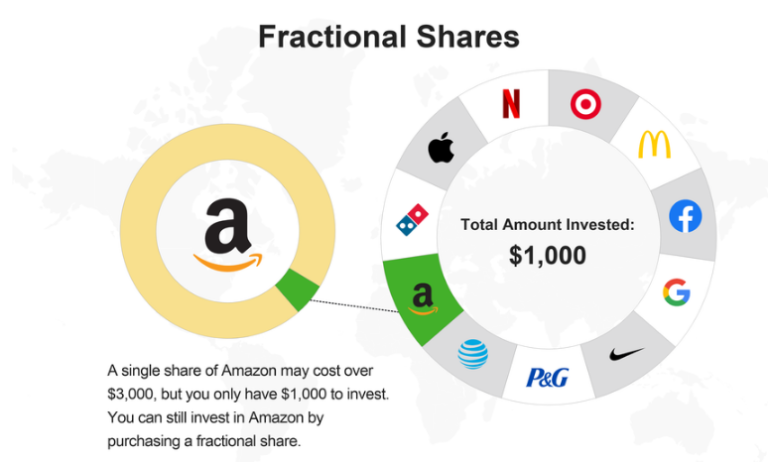

2. Fractional Shares of Stocks

Overview:

Many brokerage firms now enable investors to buy fractional shares. This would mean you could invest in companies like Amazon or Tesla without needing to pay full price for one single share of that company. This has been a fantastic way to buy high-quality stocks with smaller amounts of money.

- Average Returns: Varies by stock but can be highly fluctuating based on company performance.

- Pros: Stocks are of high value, and there is a possibility of high returns.

- Cons: Highly volatile; individual stock risk.

3. Real Estate Crowdfunding

Overview:

Real estate crowdfunding websites like Fundrise and CrowdStreet give one the chance to invest in real estate projects with a minimum investment of $500. This site aggregates funds for investments in commercial and residential property.

- Average Returns: 6-12% per annum, depending on the project.

- Pros: Diversification, high potential for generating large returns.

- Cons: Less liquidity, some risk of property devaluation.

How to Invest $10,000

With $10,000, you have the choice of many investments and can begin building a diversified portfolio to reduce risk and maximize gains.

1. Index Funds

Overview:

Index funds track a particular market index, such as the S&P 500. These are diversified and have low fees. With $10,000, you can invest in these funds to capture overall market growth.

- Average Returns: Approximately 7-10% per annum, similar to the average stock market returns.

- Pros: Low fee, diversified investment, sound long-term returns.

- Cons: Market risk, no customization.

2. Individual Stocks

Overview:

Invest the $10,000 with the goal of creating a diversified stock portfolio by identifying large, mid and small capital companies and spreading it across different industrial lines. This will therefore present growth potential and have a little bit of a customization.

- Average Returns: Can vary very widely; historical returns of diversified stock portfolios run annually between 8 and 12%.

- Pros: High return potential, customizable portfolio.

- Cons: It involves research and is volatile in nature.

3. Peer-to-Peer Lending

Overview:

Peer-to-peer lending in the form of Prosper or LendingClub gives a means of lending directly to individuals or small companies earning interest as returns for your investments, thereby giving a direct means of access to diversification in fixed-income investments.

- Average Returns: 4–9 % a year, depending upon the risk involved in the loans.

- Pros: Steady returns, low stock market correlation.

- Cons: Risk of a default, lower liquidity.

4. Cryptocurrency

Overview:

You can put a small percentage of the $10,000 into this high-risk, high-reward asset. It is known to be very volatile, but there is added value to growth in cryptocurrencies, especially with Bitcoin, Ethereum, and others.

- Average Returns: Very Volatile; one crypto can give a 20% return, whereas another results in a loss.

- Pros: High returns, diversification into a unique asset class.

- Cons: Quite volatile, with regulatory risks.

Conclusion

Investments made through $100, $1,000, or $10,000 differ. Strategies, risks, and expectations are varied when making the investment. For the former, you are limiting the choice, but in any case, you still can make good returns from the long-term low-cost diversified investments. For people who have more, diversification into stocks, ETFs, real estate, or even other alternative investments like peer-to-peer lending or even cryptocurrency is available.

Both methods have pros and cons, so it ultimately depends on your goals, risk tolerance, and timeline. Both are great for long-term success and should be followed by diversification and regular contributions like any other investment.

FAQs

Is it worth investing with only $100?

Answer: Yes! Even with a small amount like $100, you can start building an investment habit. Options like micro-investing apps and robo-advisors make it possible to grow even small investments over time. Starting with $100 teaches you about investing while potentially earning modest returns.

How can I double my $10,000 investment?

Answer: Doubling an investment typically requires higher-risk options or a longer investment period. Investing in individual stocks, real estate crowdfunding, or a well-chosen cryptocurrency may help reach this goal, though it carries more risk. Alternatively, investing in diversified index funds and holding them over a long period (5-10 years or more) can lead to steady growth.

Are robo-advisors a good choice for beginners?

Answer: Yes, robo-advisors are a popular choice for beginners as they offer low fees, diversified portfolios, and require minimal management. They use algorithms to choose investments based on your goals and risk tolerance, making them ideal for those who want a hands-off approach.

Owner of Paisewaise

I’m a friendly finance expert who helps people manage money wisely. I explain budgeting, earning, and investing in a clear, easy-to-understand way.

Pingback: How to Save for a House ? - Paisewaise

Pingback: Best Banks for Savings Accounts - Paisewaise

This blog is going directly in my favorites, well done.

Your website is a fantastic tool for experts in related industries.

What’s up everyone, it’s my first visit at this site, and article is really fruitful in support of me, keep up posting such content.