Introduction

When considering saving, someone seeking to save a lot would be best interested in applying with a Compound Interest Calculator; its purpose is to help you grasp abstract interest rates in hard, concrete numbers. Indeed, it helps with visualizing one’s ability to save by how rapidly growth will occur within time and it makes sense only if an individual plans their future to be long.

What is a Compound Interest Calculator?

Compound interest calculator: A tool that calculates the amount of investment or savings balance over a period when interest is compounded. Compound interest is defined as the interest earned on the original amount as well as on the interest acquired from previous periods. Thus, the growth of such savings can be exponential and greatly impact one’s savings.

Why Use a Compound Interest Calculator?

It is always difficult to understand compound interest without a proper tool. A compound interest calculator works in the following manner:

- It demonstrates how added contributions compounded over time can build wealth.

- That will help you compare different interest rates and compounding frequencies.

- It will be a guide on how to set proper realistic financial goals through growth visuals.

How Compound Interest Works

Interest paid on interest accrued already as at previous periods adds this compound interest. In its method of calculation, simple interest is different. Since the person can only take in a percentage of the sum, there is no such thing as growth in compund interest.

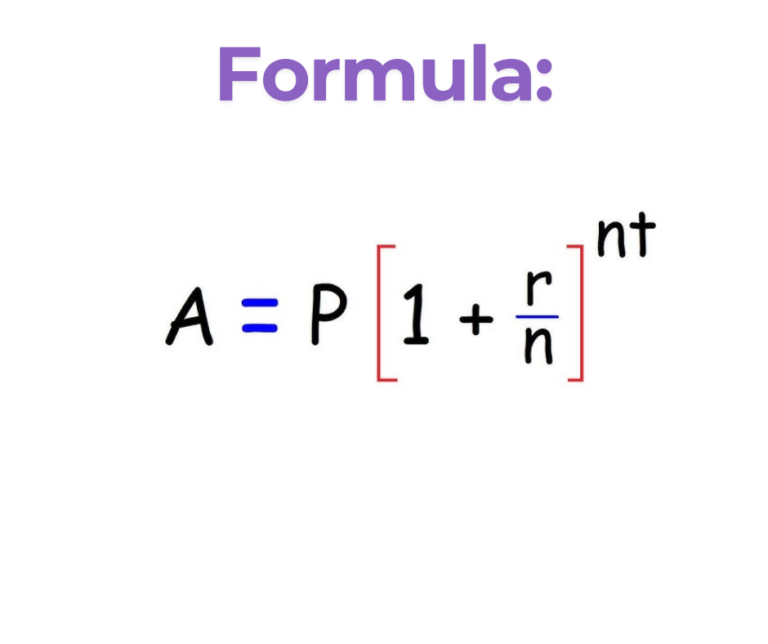

Where:

- A = the amount of money accumulated after n years, including interest.

- P = the principal amount (initial investment).

- r = annual interest rate.

- n = number of times that interest is compounded per year.

- t = the number of years the money is invested for.

Setting Your Financial Goals with a Compound Interest Calculator

One of the greatest uses for a compound interest calculator is financial goals. Are you saving for retirement or to educate your children? Do you have that dream car that you‘d love to have someday? In all these cases, this is what you can do:

- Establish Your Goal Amount: You should always know precisely what you’re saving for—a goal, whether that is to buy your first house, retirement, or something that you simply would like to own.

- Enter how often you will contribute: Include information about how often you will make deposits.

- Experiment with interest rates: See how different rates impact your timeline and final amount.

Steps to Use a Compound Interest Calculator Effectively

Follow the following steps for the most accurate results:

- Principal Amount: Input the amount you want to invest first.

- Select the interest rate: Determine the realistic rates for your chosen financial product.

- Set the compounding frequency: monthly, quarterly, or annually—all affect the outcome.

- Determine the time period: The more extended time horizons are, the greater the compound growth.

- Add regular contributions (optional): Many calculators allow you to add regular contributions, which can add a lot of money over time.

Real-Life Scenarios: See How Compound Interest Boosts Your Savings

Let‘s take a few examples of how to apply a compound interest calculator to planning:

- Retirement Planning: The compound effect is really deep for long-term goals. If you put down 10,000 dollars into an account with a 5% annual interest rate compounded monthly over 30 years, it can actually grow into a considerable sum.

- Saving for Education: Parents can set aside small amounts monthly and allow compound interest to grow the funds for their children‘s education.

- Emergency Fund Growth: The monthly contribution to an account with compound interest would accrue to a sizeable reserve in just a few years.

Conclusion: Start Growing Your Wealth Today

A compound interest calculator is a financial tool but, beyond that, a roadmap for building wealth and achieving goals. You will see the power of time and consistent contributions in maximizing returns in such things. This means you are empowered to save wisely. Use a compound interest calculator today and transform the way you save into a march toward true financial security.

FAQs

What is the difference between simple interest and compound interest?

Simple interest only calculates interest on the principal amount, while compound interest calculates interest on both the initial principal and accumulated interest, leading to a faster growth rate. Compound interest offers greater returns over time, making it ideal for long-term savings.

How often is interest compounded in a compound interest calculation?

The frequency of compounding varies based on the account or investment. Common compounding frequencies include:

- Daily

- Monthly

- Quarterly

- Annually

How accurate is a Compound Interest Calculator?

A Compound Interest Calculator provides accurate projections based on the inputs you give. However, real-life returns can vary due to changes in interest rates, fees, or external factors affecting your investment. Use it as a guide rather than a guaranteed result.

Can I calculate loan interest with a Compound Interest Calculator?

While a Compound Interest Calculator is typically used for savings and investments, it can also provide insights into how interest accumulates on loans with compounded interest. For specific loan terms and interest calculations, however, a loan or mortgage calculator may provide more tailored results.

Pingback: How to Start Investing with Little Money - Paisewaise