Introduction

The financial climate has changed over the years, thus having investors look for alternative ways of ensuring wealth preservation. Of all these alternatives, there is perhaps one that people are really interested in: a Gold IRA. The guide below looks into what a Gold IRA is, how it works, its benefits, and how to set it up.

What is a Gold IRA?

An IRA in gold is a type of special retirement account whereby you are allowed to invest in physical gold and also other precious metals. In distinction to traditional IRAs that hold paper assets like stocks and bonds, a gold IRA holds tangible ones. Such diversity can serve as an inflation hedge and economic uncertainty.

How Does a Gold IRA Work?

Like a traditional IRA, a Gold IRA varies in the following:

1. Setup: You can open a Gold IRA via a custodian—a financial institution that administers your account and also adheres to the rulings of the IRS.

2. Funding: Gold IRA funding comes in the form of a rollover from another retirement account. The IRS sets specific limits on contribution; therefore, there is a need to know them.

3. Buying Gold: After funding is made, you can invest in any eligible gold or precious metals. As concerns any purity requirements, the IRS does have requirements that must be met for eligibility into a Gold IRA.

4. Storage: While ordinary bullion can be stored in a safe at home or at some other secure, personally owned location, physical gold must be held in a qualified, IRS-approved depository.

Benefits of a Gold IRA

There are a good number of benefits that come with investing in a Gold IRA.

1. Diversification: It gives you the opportunity to diversify your retirement portfolio, which reduces the risk. Indeed, gold is known to move independently of stocks and bonds.

2. Hedge Against Inflation: Gold has preserved its value throughout the years whenever the economy went into a downturn while other fiat currencies lost purchasing power.

4. Tax Benefits: Like the traditional IRAs, Gold IRAs grow tax-deferred. This means you never pay taxes on your profit until it is withdrawn during your retirement.

5. Physical Asset: Unlike stocks or bonds, you can hold gold in your hand; this tends to give most investors some sense of security.

How to Set Up a Gold IRA

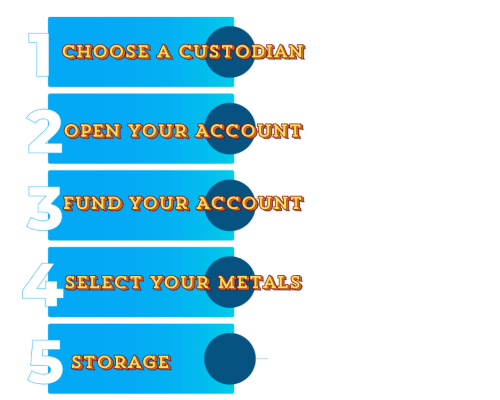

You will be required to follow the following simple steps to open a Gold IRA.

1. Choose a Custodian: You should do a search and pick a custodian that specifically specializes in Gold IRAs. Confirm their fees, services, and reviews.

2. Open Your Account: You will need to prepare and forward most of the paperwork to open your Gold IRA. This usually involves identification and some forms that you may need to fill out in regard to your financial situation.

3. Fund Your Account: Decide through which mechanism you will contribute funds to the gold IRA, either by rollover, transfer, or direct contribution. Remember to adhere to the IRS rules so that you do not incur penalty fees.

4. Select Metals: Through your custodian, find the gold and any other precious metals you may desire in your retirement account. They should be able to qualify that these metals will be suitable for the standards of the IRS.

5. Storage: Your gold needs to be held in an IRS-approved depository. Your custodian can help arrange for this.

Conclusion

A gold IRA could be the icing on the cake in retirement planning. Investing in physical gold allows for diversification of a portfolio, hedging against inflation, and receiving tax benefits of all sorts. If you are setting up a gold IRA, you are wise to seek advice from a financial advisor so you make the right decision for your financial goals.

FAQs

Q. Is it allowed to be held at my home?

- No, you are prohibited from holding IRA gold privately according to IRS regulations. Your metals must remain in an IRS-compliant depository to preserve the tax benefits that the account provides. Home storage might result in penalties or even disqualification of your IRA.

Q. What’s the difference between a gold IRA and a traditional IRA?

- A traditional IRA invests in paper assets in the form of stocks, bonds, and mutual funds, while a gold IRA uses physical metals. These also require custodians that specialize in precious metals, with additional storage fees added on.

Q. What types of precious metals can be invested in using a Gold IRA?

The IRS allows including gold, silver, platinum, and palladium in the scheme, so long as they are of certain purity. Specifically:

- Gold: at least 99.5% pure.

- Silver: At least 99.9% purity

- Platinum and palladium: 99.95% minimum purity

Q. How soon can I take money out of my Gold IRA?

- You are allowed to take distributions penalty-tax-free beginning at age 59½. Withdrawals at ages younger than 59½ may be subject to withdrawal penalties. You also must start taking RMDs at age 73.

Q. Is a Gold IRA insured?

- While depositories can ensure security, your gold isn’t covered under FDIC (as it is with cash deposits). Many depositories do, though, offer private insurance for precious metals stored within their facilities.

Your enthusiasm is contagious, igniting excitement and curiosity about the topics you discuss.

You have an remarkable ability to transform everyday subjects into captivating articles. Keep up the outstanding work!