Introduction

Do you want to convert your cash into gold and build wealth or investments? With increasing economic uncertainty, many are turning towards gold—a tried and tested asset known for retaining value over time. However, the creation of cash into gold requires careful steps so that an individual does not fall prey to frauds or financial losses. We will therefore take you through the top five safe and reliable methods to help turn your cash into gold, giving you peace of mind while building up wealth.

1. Purchase Gold Bullion and Coins from Reputable Dealers

Buying gold bullion or coins is, perhaps, the most obvious way to turn your cash into actual gold.

- The bars of gold bullion vary in size from one gram to one kilogram or more.

- Gold coins, such as the American Gold Eagle or Canadian Maple Leaf, are much smaller and easier to trade.

Why this option is safe:

Select dealers that are accredited by well-known bodies, such as the London Bullion Market Association (LBMA) or American Numismatic Association (ANA). Review ratings and reviews of the dealer before any purchase.

Tips for Security:

- Ensure that you obtain an authenticity certificate.

- Store your gold in a bank vault or a safe at home.

2. Use Online Gold Marketplaces for Convenience

You can buy, store, and even sell gold through several online sites.

- Buy gold at the click of a mouse through websites such as GoldSilver, APMEX, and JM Bullion.

- The vault storage in some of the platforms is provided to keep risks of storage at your home away, thus assuring a safe investment platform.

Why this option is safe:

Most of these companies also ensure that the deliveries or storage are covered in case something goes wrong and have strict regulations to safeguard users against fraudsters.

Tips for Security:

- Always buy from established platforms with secure payment options.

- Look for websites that use encryption technology to protect your personal data.

3. Exchange Cash for Gold ETFs (Exchange-Traded Funds)

You never want or know how to handle the gold in physical form; you can change your cash into Gold ETFs. These funds track the price of gold, and you will be exposed to this asset, but it will not become a headache for you in terms of storage.

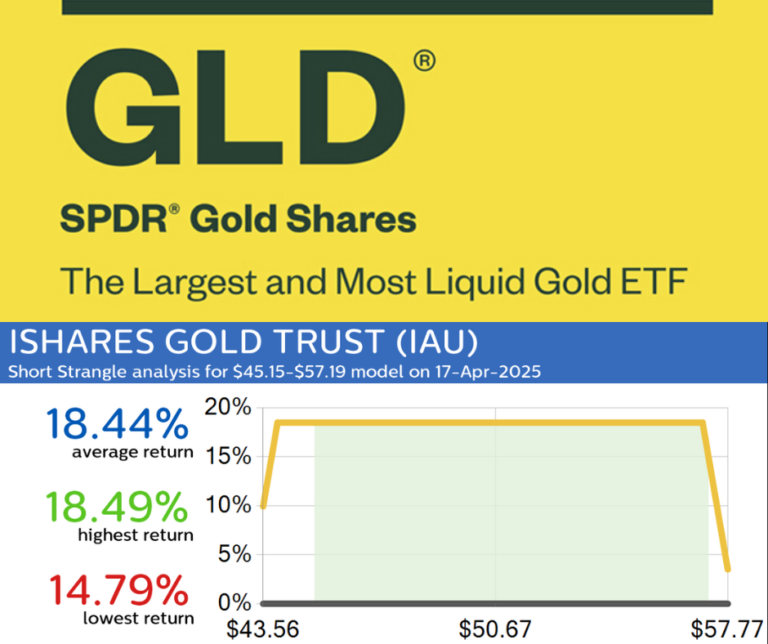

- Popular ETFs: SPDR Gold Shares (GLD) or iShares Gold Trust (IAU).

Why this option is safe:

These are in the form of ETFs and thus tracked, governed by government agencies, and their trading occurred on the stock exchanges.

Tips for Security:

- Open an account with a reputable online brokerage firm so that you can buy ETFs.

- Follow the change in the price of gold and the conditions in the market.

4. Participate in Gold Savings Schemes for Long-Term Growth

Many jewelers and financial institutions have gold savings schemes. Here you can invest small amounts of cash over a period of time, which would accrue into physical gold or gold jewelry.

How it works:

- You begin making monthly cash deposits, and at the culmination of the tenure of the scheme, usually after 6 to 12 months, you get your savings in the form of gold.

Why this option is safe:

Many known jewelers along with financial institutions provide these schemes with fixed rates to save your investment from any fluctuations in the market.

Tips for Security:

- Check the authenticity of the jeweler or financial institution before you enroll.

- Clear terms with no hidden charges.

5. Use Gold-Backed Digital Wallets for Easy Conversion

Most fintech companies have invented gold-backed digital wallets. This allows a user to convert cash into gold online and redeem it in the physical form of gold or equivalent cash at a given time.

- Examples include Vaultoro, Glint, and Paxos Gold (PAXG).

Why this option is safe:

These sites store gold in insured vaults and follow tight compliance regulations regarding finance. Some even let you load a debit card against your gold balance.

Tips for Security:

- Select wallets insured and regulated.

- Check periodically on the website’s transparency reports about gold reserves.

Conclusion: Pick the Best Strategies That Safely Convert Your Money to Gold

There is, on the other hand, a choice: gold in physical form for this case or having all the benefits brought by digital convenience. Buying bullion, online marketplaces, ETF investments, savings schemes, and even gold-backed wallets can also be used as ways to change your cash into gold. When shopping, it would be better if bought from reputable vendors and for one to monitor the market trend. These kinds of investments, aside from being attractive, also demand attention for safety measures. With the right approach, transforming your cash into gold is a reasonably smooth and secure process.

FAQs

Q. Is it better to invest in gold or hold cash?

- Yes. Gold tends to hold its value during inflationary periods and market uncertainty; it is a relatively safer investment for longer-term wealth protection.

Q. What are the ways I avoid scams when buying gold?

- Always source from a dealer or seller who is registered or verified. Ensure to get certificates of authenticity and check reviews by other customers.

Q. Can I exchange cash into gold without holding it?

- You can invest in gold ETFs or use gold-backed digital wallets to invest in gold without ever holding the metal. Yes.

Owner of Paisewaise

I’m a friendly finance expert who helps people manage money wisely. I explain budgeting, earning, and investing in a clear, easy-to-understand way.

I’m appreciative for the examples you shared; they made it easier to comprehend.