What Is Peer-to-Peer Lending? A Complete Guide for Beginners

The financial world is evolving rapidly, and one innovation that’s reshaping how people borrow and lend money is peer-to-peer lending. If you’ve ever felt frustrated by traditional banks’ rigid requirements or low savings account returns, peer-to-peer lending might offer an interesting alternative. But what exactly is it, and is it right for you?

Introduction to Peer-to-Peer Lending

Peer-to-peer lending, often abbreviated as P2P lending, is a method of borrowing and lending money directly between individuals without involving traditional financial institutions like banks. Through online platforms, borrowers seeking loans connect with investors willing to fund those loans in exchange for interest payments.

The concept of peer-to-peer lending is gaining tremendous popularity worldwide because it offers something that appeals to both sides of the transaction. Borrowers often access funds more quickly and at lower interest rates than traditional banks offer, while investors can earn higher returns than they’d get from savings accounts or fixed deposits.

What makes peer-to-peer lending fundamentally different from traditional banking is the elimination of the middleman. Banks typically borrow money from depositors at low interest rates and lend it out at much higher rates, pocketing the difference. Peer-to-peer lending platforms simply facilitate connections between borrowers and lenders, taking a smaller fee for their services.

How Does Peer-to-Peer Lending Work?

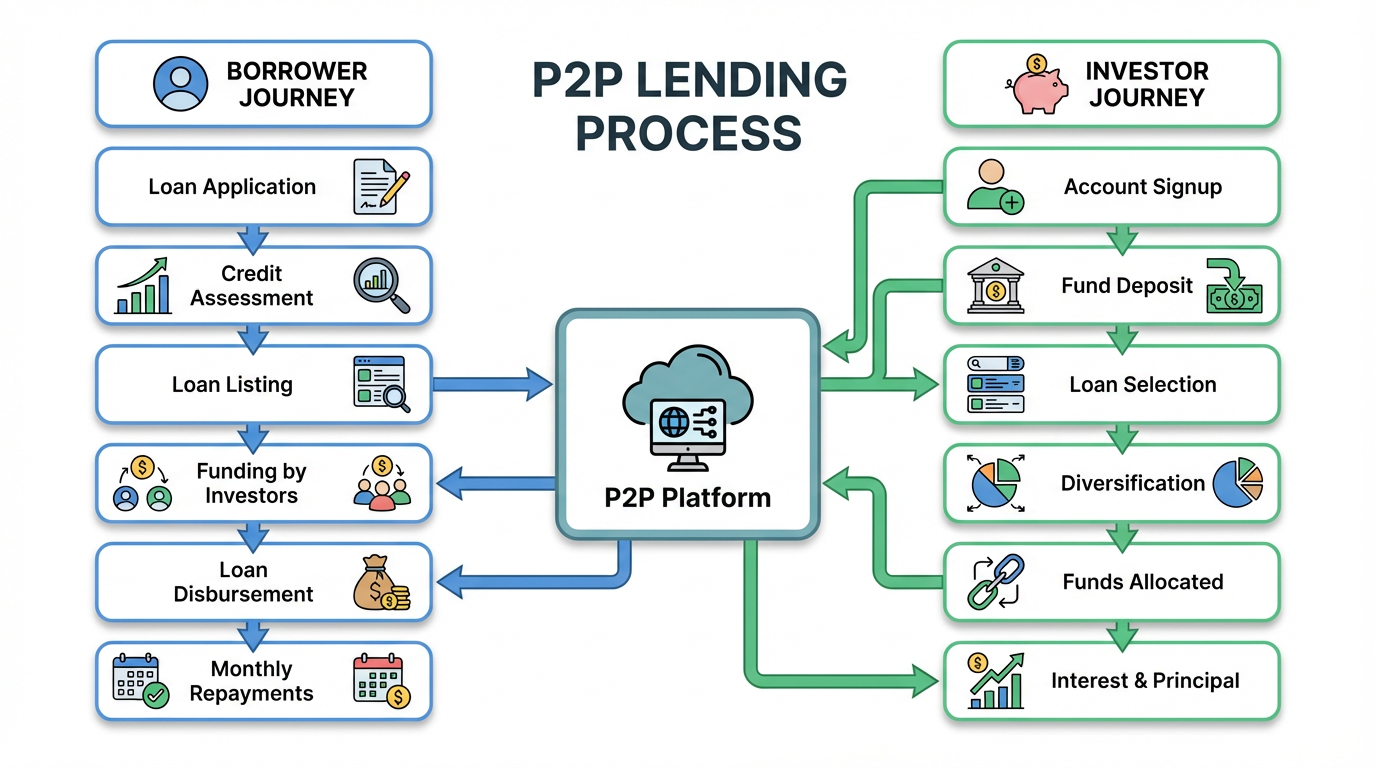

Understanding the mechanics of peer-to-peer lending is simpler than you might think. The process involves three key players: the borrower, the investor, and the platform that brings them together.

For borrowers, the journey typically follows these steps:

- Create an account on a peer-to-peer lending platform

- Submit a loan application with the required documents

- The platform assesses your creditworthiness and assigns a risk grade

- Your loan request gets listed on the platform marketplace

- Investors review and fund your loan (partially or fully)

- Once funded, you receive the money and begin making monthly repayments

For investors, the process looks like this:

- Register on the platform and complete identity verification

- Browse available loan listings with different risk profiles

- Review borrower information, credit scores, and loan purposes

- Choose loans to invest in (you can diversify across multiple loans)

- Transfer funds to invest in selected loans

- Receive monthly repayments with interest as borrowers pay back

Peer-to-peer lending platforms use sophisticated algorithms and credit assessment tools to evaluate borrower risk. They analyze credit scores, income verification, employment history, existing debts, and sometimes even social media profiles to determine the likelihood of repayment.

Pros and Cons of Peer-to-Peer Lending

Like any financial product, peer-to-peer lending comes with its own set of advantages and disadvantages.

Advantages of Peer-to-Peer Lending

Lower interest rates for borrowers: Without the overhead costs of physical branches and large staff, peer-to-peer lending platforms can offer competitive rates, especially for borrowers with good credit profiles.

Higher potential returns for investors: Investors can earn returns typically ranging from 6% to 12% annually, significantly higher than traditional savings accounts that often offer less than 3%.

Faster approval and digital onboarding: The entire process happens online, meaning loan approvals can take days instead of weeks, and funds can be disbursed quickly once a loan is fully funded.

Disadvantages of Peer-to-Peer Lending

Default risk: Borrowers may fail to repay loans, resulting in losses for investors. Unlike bank deposits, peer-to-peer lending investments aren’t typically insured by government schemes.

Limited regulation in some regions: The regulatory framework for peer-to-peer lending varies significantly by country, with some markets offering robust consumer protection while others remain largely unregulated.

Platform fees and liquidity concerns: Platforms charge fees for their services, and unlike stocks or bonds, you generally can’t easily sell your peer-to-peer lending investments before the loan term ends.

Is Peer-to-Peer Lending Safe?

Safety is naturally a primary concern for anyone considering peer-to-peer lending. While it’s not risk-free, reputable platforms implement several protective measures.

Most established platforms conduct thorough credit scoring and borrower verification processes, checking identity documents, bank statements, and credit histories. Some platforms also offer contingency funds that provide partial protection against defaults, though coverage varies.

For investors, the key risk mitigation strategy is diversification, rather than putting all your money into one loan; spreading investments across 50 or 100 different loans significantly reduces the impact of any single default.

From a regulatory perspective, peer-to-peer lending oversight varies globally. Some countries have specific regulations governing these platforms, requiring licenses, capital reserves, and transparent reporting. Always check whether a platform is properly registered and regulated in your jurisdiction.

How Much Can You Earn From Peer-to-Peer Lending?

The potential returns from peer-to-peer lending investments depend on several factors, including the risk profile of loans you choose, the platform’s default rates, and fees charged.

| Investment Type | Typical Annual Returns | Risk Level |

|---|---|---|

| Savings Account | 2-3% | Very Low |

| Fixed Deposits | 3-5% | Very Low |

| Peer-to-Peer Lending | 6-12% | Medium to High |

| Mutual Funds | 8-15% | Medium to High |

Factors affecting your actual returns include:

- The creditworthiness of borrowers you fund

- Platform fees and service charges

- Default rates and recovery percentages

- The loan duration and reinvestment frequency

It’s important to set realistic expectations. While the advertised returns might be attractive, actual returns after defaults and fees are typically lower. Most experienced investors target net returns of 6-8% after accounting for all costs and defaults.

Who Should Use Peer-to-Peer Lending?

Peer-to-peer lending isn’t suitable for everyone, but certain profiles tend to benefit most.

Ideal borrowers include individuals who have decent credit scores but might not qualify for the best bank rates, those seeking faster approvals for personal loans, or borrowers who prefer transparent, digital-first lending processes.

Ideal investors are those with emergency funds already established, who understand and can tolerate investment risk, who have funds they won’t need for at least 1-3 years, and who are comfortable with technology-based investing.

Peer-to-peer lending may not be suitable if you need guaranteed capital protection, require immediate liquidity, cannot afford to lose any of your invested capital, or are completely unfamiliar with investment concepts.

Peer-to-Peer Lending vs Traditional Loans

| Feature | Peer-to-Peer Lending | Traditional Bank Loans |

|---|---|---|

| Interest Rates | Often lower (8-18%) | Variable (10-24%) |

| Approval Time | 3-7 days | 1-4 weeks |

| Paperwork | Minimal, digital | Extensive |

| Eligibility | Flexible criteria | Strict requirements |

| Collateral | Usually unsecured | Often required |

| Early Repayment | Usually allowed | May have penalties |

Traditional banks offer the security of established institutions and deposit insurance, while peer-to-peer lending platforms provide speed, convenience, and potentially better rates. Your choice depends on your priorities, urgency, and risk tolerance.

Common Risks in Peer-to-Peer Lending (And How to Manage Them)

Borrower default risk is the most obvious concern. Some borrowers will inevitably fail to repay. Manage this by diversifying investments across many loans, favoring higher credit-grade borrowers, and starting with small amounts.

Platform risk exists because if the platform itself fails or shuts down, recovering your investments becomes complicated. Stick with established, well-regulated platforms with track records.

Liquidity risk means you can’t easily access your money before the loan terms end. Only invest money you won’t need in the short term, and consider platforms offering secondary markets where you can sell loans to other investors.

Diversification strategies are your best defense. Invest in at least 50-100 different loans, spread investments across different risk grades and loan purposes, and don’t put more than 10% of your total investment portfolio into peer-to-peer lending.

Frequently Asked Questions About Peer-to-Peer Lending

Q. How does peer-to-peer lending work for beginners?

- Start by researching reputable platforms, begin with small investments to learn, use auto-invest features that automatically diversify your funds, and reinvest returns to benefit from compounding.

Q. Is peer-to-peer lending better than banks?

- It depends on your needs. For borrowers with good credit seeking quick, competitive loans, it can be excellent. For investors seeking higher returns and accepting more risk, it offers opportunities. But banks provide security and insurance that peer-to-peer lending platforms typically don’t.

Q. Can you lose money in peer-to-peer lending?

- Yes, absolutely. Borrower defaults can result in partial or total loss of invested capital. This is why diversification and careful selection are crucial.

Q. How do you start investing in peer-to-peer lending?

- Choose a regulated platform in your country, complete the registration and verification process, start with a small amount you can afford to lose, diversify across multiple loans, and monitor your portfolio regularly.

Final Thoughts: Is Peer-to-Peer Lending Worth It?

Peer-to-peer lending represents an innovative financial tool that can benefit both borrowers and investors when used appropriately. For borrowers, it offers potentially lower rates, faster approvals, and a more accessible alternative to traditional banks. For investors, it provides an opportunity to earn higher returns than savings accounts while supporting real people’s financial needs.

However, it’s not without risks. The lack of deposit insurance, default possibilities, and liquidity constraints means peer-to-peer lending should only be considered after you’ve established emergency savings and understand investment fundamentals.

Who should consider it seriously? Borrowers with decent credit seeking personal loans for consolidation, home improvements, or major purchases might find excellent value. Investors with disposable income, some investment experience, and a medium-term time horizon could add peer-to-peer Lending as one component of a diversified portfolio.

The key to success with peer-to-peer lending is education, diversification, and realistic expectations. Start small, learn from experience, and never invest more than you can afford to lose. With the right approach, peer-to-peer lending can be a valuable addition to your financial toolkit.

Remember, while this guide provides general information about peer-to-peer lending, it’s not financial advice. Consider consulting with a financial advisor before making investment decisions, and always research specific platforms thoroughly before committing your money.

Peer-To-Peer Lending peer-to-peer lending Peer To Peer Lending

Owner of Paisewaise

I’m a friendly finance expert who helps people manage money wisely. I explain budgeting, earning, and investing in a clear, easy-to-understand way.

Pingback: Are Digital Financial Services Secure? - Paisewaise

Pingback: 10 Best Investment Opportunities in 2025 - Paisewaise

Pingback: From $100 to $10,000: The Truth About Passive Income Potential - Paisewaise

Your determination and enthusiasm resonate in every section you pen. It’s truly inspiring.

I appreciate how you analyze complex ideas into easily understandable ideas. You’re a fantastic educator.

I love your blog.. very nice colors & theme. Did you create this website yourself? Plz reply back as I’m looking to create my own blog and would like to know wheere u got this from. thanks

Thank you so much for the kind feedback—I’m glad you like the design and theme. Yes, I created the website myself using a customizable blogging platform and a premium theme, which I then tailored to fit my needs. If you’re planning to start your own blog, there are many great tools available today that make the process straightforward, even for beginners. Feel free to let me know if you’d like recommendations or guidance to get started.

Pingback: What is Passive Income? Your Complete Guide to Building Wealth While You Sleep