Starting a Business vs. Investing in Stocks: Which Path to Wealth Is Right for You?

The age-old question that keeps aspiring wealth-builders awake at night: should you pour your savings into starting a business or let the stock market work its magic? Both paths have minted millionaires, and both have left others wondering what went wrong. The choice between starting a business and investing in stocks isn’t just about money—it’s about lifestyle, risk tolerance, and your vision for the future.

In this comprehensive guide, we’ll dissect both wealth-building strategies, compare their real-world outcomes, and help you determine which path aligns with your financial goals. Whether you’re a corporate professional with $50,000 to invest or a recent graduate with just $1,000, understanding these options could be the difference between building lasting wealth and spinning your wheels.

Understanding the Basics

What It Means to Start a Business

Starting a business means creating an enterprise that provides products or services to customers in exchange for profit. This could range from launching an e-commerce store selling handmade goods to opening a consulting firm or developing a software application.

Common business models include service-based businesses (consulting, agencies), product-based ventures (retail, manufacturing), franchise operations, and digital businesses (SaaS, content platforms). The defining characteristic? You’re building something from scratch, and your active participation directly impacts success.

Capital requirements vary dramatically. A freelance writing business might need just $500 for a website and basic tools, while a restaurant could require $250,000 or more. Beyond money, starting a business demands operational responsibilities: managing employees, handling customer complaints, navigating regulations, and making countless daily decisions that determine survival.

[Image Suggestion: Split-screen showing an entrepreneur at a laptop with business planning documents on one side, and a retail storefront on the other]

What Investing in Stocks Involves

Investing in stocks means purchasing ownership shares in publicly traded companies. When you buy Apple stock, you become a partial owner of Apple Inc., entitled to a portion of its profits and growth.

Stock investors typically fall into three categories: long-term investors who buy and hold for years, dividend investors seeking regular income payments, and growth investors targeting companies with high appreciation potential. The beauty of stock investing lies in its passive nature—you can invest $5,000 today and let professional managers run the companies while you focus on your day job.

Modern investing offers unprecedented accessibility. Platforms like Vanguard, Fidelity, and Robinhood allow anyone to start with as little as $1, purchasing fractional shares of expensive stocks. This democratization has transformed investing from an elite activity to an everyday wealth-building tool.

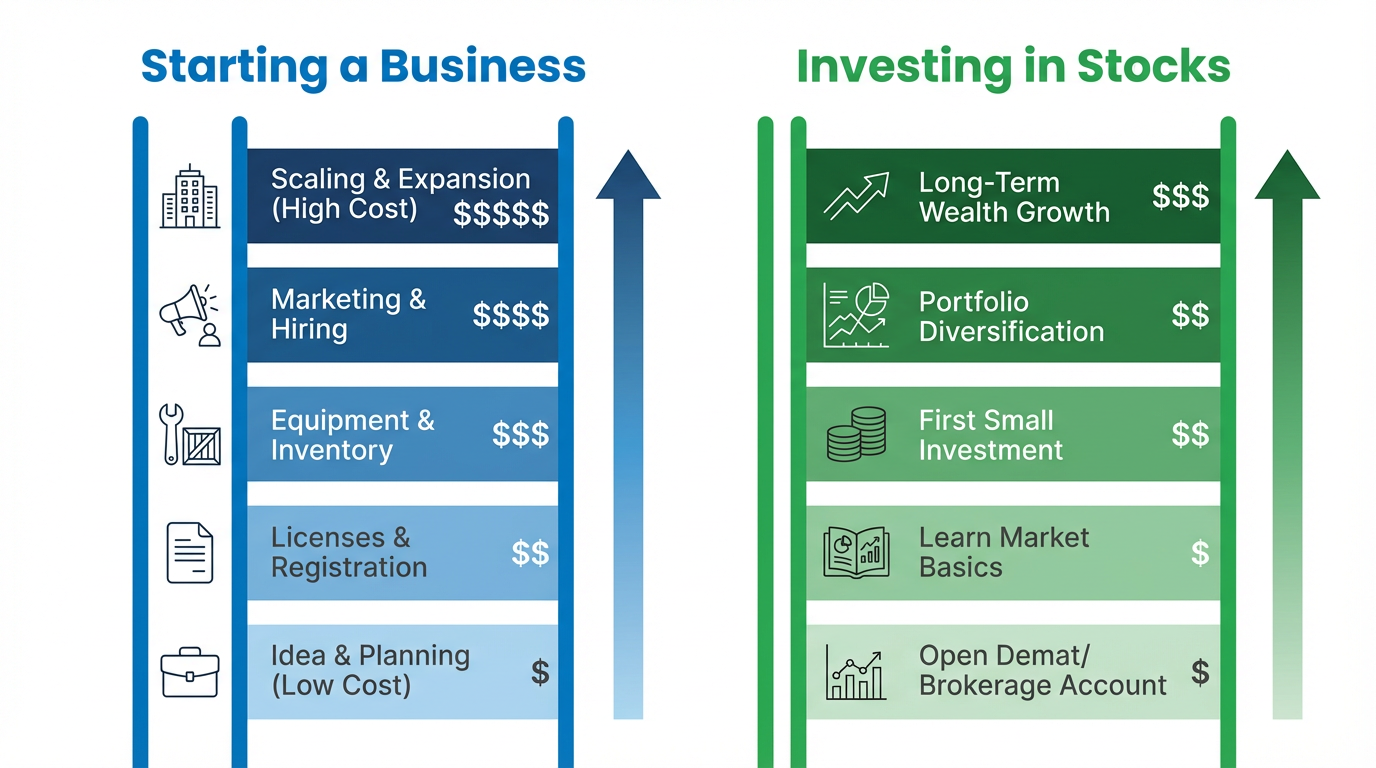

Capital Requirements and Accessibility

The barrier to entry reveals the first major distinction between starting a business and investing in stocks.

Starting a Business:

- Service business: $500–$5,000

- Small retail shop: $10,000–$50,000

- Restaurant: $100,000–$500,000

- Manufacturing: $250,000–$1,000,000+

- Franchise: $50,000–$500,000

Investing in Stocks:

- Minimum investment: $1 (fractional shares)

- Recommended starting amount: $1,000–$5,000

- Well-diversified portfolio: $10,000+

| Factor | Starting a Business | Investing in Stocks |

|---|---|---|

| Minimum Capital | $500–$500,000+ | $1–$100 |

| Average Starting Investment | $30,000–$50,000 | $1,000–$5,000 |

| Additional Funding Needs | Often required for growth | Optional (can add regularly) |

| Accessibility | Moderate to difficult | Extremely accessible |

The stock market wins decisively on accessibility. Anyone with internet access can start investing today, while starting a business often requires substantial capital, business plans, and months of preparation.

Risk and Return Comparison

Both paths carry significant risks, but they manifest differently.

Business Risks:

According to the U.S. Bureau of Labor Statistics, approximately 20% of small businesses fail within their first year, and about 50% fail within five years. The reasons vary: insufficient capital, poor location, inadequate market research, strong competition, or simply bad timing.

Operational risks include losing key employees, supply chain disruptions, lawsuit exposure, and economic downturns affecting your specific industry. Unlike stocks, you can’t instantly diversify away from these risks—your business is your business.

However, successful businesses can generate extraordinary returns. Many entrepreneurs build companies worth 10–100 times their initial investment, and you control the outcome through your decisions and execution.

Stock Market Risks:

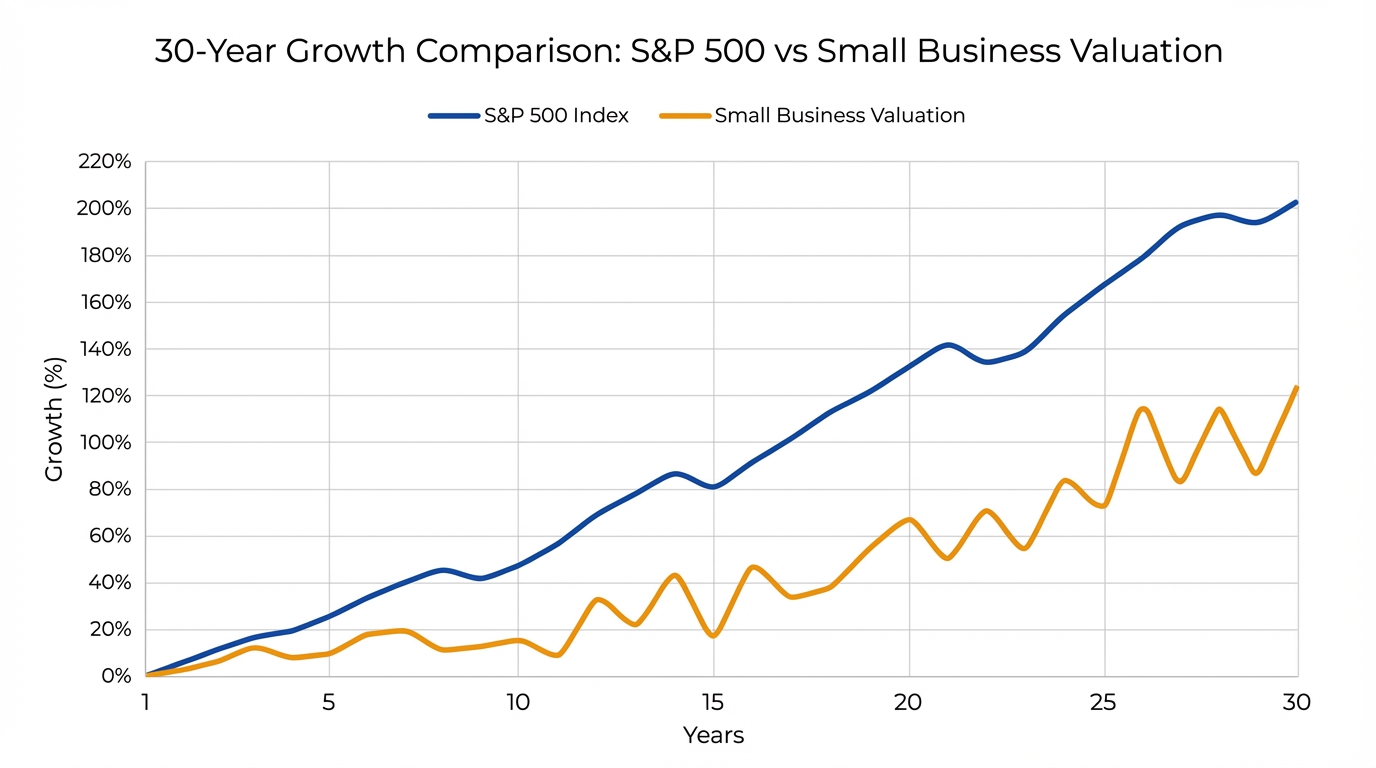

Stock investing faces volatility, market crashes, and company-specific disasters. The S&P 500 has experienced several brutal downturns: the 2000–2002 dot-com crash (−49%), the 2008 financial crisis (−57%), and the 2020 COVID crash (−34%).

Yet historical data show remarkable resilience. Over the past 100 years, the S&P 500 has returned approximately 10% annually on average. A $10,000 investment growing at 10% annually becomes $174,000 in 30 years without adding another dollar.

| Metric | Starting a Business | Investing in Stocks |

|---|---|---|

| Failure Rate (5 years) | ~50% | ~0% (diversified portfolio) |

| Average Annual Return | Highly variable (−100% to +500%+) | 7–10% (long-term average) |

| Risk of Total Loss | Moderate to high | Low (with diversification) |

| Potential Peak Returns | Unlimited | 10–15% annually (realistic) |

Time Commitment and Lifestyle Impact

This factor often receives insufficient attention, yet it profoundly affects quality of life.

Starting a Business:

Entrepreneurs typically work 50–70 hours weekly during the startup phase, often for years. You’re simultaneously the CEO, accountant, marketing director, and janitor. Vacations become difficult. Family dinners get interrupted by customer emergencies. The business dominates your mental space even during off-hours.

This isn’t necessarily negative—many entrepreneurs thrive on the intensity and find deep fulfillment in building something meaningful. But the commitment is undeniable and often underestimated by first-time founders.

Investing in Stocks:

Stock investing can require as little as 1–5 hours monthly for passive investors using index funds. Even active investors rarely need more than 5–10 hours weekly for research and portfolio management. You maintain your current career, enjoy regular vacations, and sleep soundly knowing the stock market doesn’t need you to open the doors each morning.

The lifestyle difference is stark: starting a business is an all-consuming endeavor, while investing in stocks complements your existing life.

Scalability and Growth Potential

Business Scalability:

Some businesses scale magnificently. Software companies, digital products, and franchise models can grow exponentially with minimal additional cost per customer. Others face hard limits—a solo consultant can only work so many hours, and a restaurant has a finite seating capacity.

Scaling usually requires additional capital, hiring talent, operational complexity, and often diluting ownership through investors. The process is challenging but potentially lucrative. Companies like Microsoft, Amazon, and Facebook started small and became trillion-dollar enterprises.

Stock Market Compounding:

Einstein allegedly called compound interest “the eighth wonder of the world.” Investing in stocks harnesses this power automatically. A $10,000 investment at 10% annual returns becomes $17,449 in 5 years, $45,259 in 15 years, and $174,494 in 30 years—without any active effort beyond the initial investment.

Adding regular contributions accelerates growth dramatically. Investing $500 monthly at 10% annual returns generates $1.1 million in 30 years from just $180,000 in total contributions.

Liquidity and Exit Options

Liquidity—the ability to convert your investment to cash quickly—varies enormously between these options.

Business Liquidity:

Selling a business is complex, time-consuming, and uncertain. Finding qualified buyers, negotiating terms, transferring operations, and finalizing legal agreements can take 6–24 months. Many small businesses never find buyers and simply close when the owner retires.

Business valuations typically range from 1–5 times annual profits, depending on industry, growth trajectory, and operational systems. Service businesses often fetch lower multiples than product companies with recurring revenue.

Stock Liquidity:

Stocks offer near-perfect liquidity. You can sell your entire portfolio and have cash in your bank account within 3–5 business days. This accessibility provides enormous peace of mind during emergencies and creates flexibility for pursuing unexpected opportunities.

The only caveat: selling during market downturns locks in losses, so stocks work best for money you won’t need for 5–10+ years.

Taxation and Legal Considerations

Tax treatment significantly impacts net returns and should influence your decision.

Business Taxation:

Business income faces self-employment tax (15.3% on the first $168,600 for 2024) plus regular income tax rates up to 37%. However, business owners enjoy numerous deductions: home office expenses, equipment purchases, travel costs, health insurance premiums, and retirement contributions.

Many businesses are structured as S corporations or LLCs to optimize tax treatment, potentially saving thousands annually. The complexity requires professional accounting help, adding operational costs.

Stock Market Taxation:

Long-term capital gains (investments held over one year) are taxed at preferential rates: 0%, 15%, or 20%, depending on income, significantly lower than ordinary income tax rates. Dividends from qualified stocks receive similar favorable treatment.

Tax-advantaged accounts like 401(k)s and IRAs offer even better benefits: tax-deferred or tax-free growth. A maxed-out 401(k) ($23,000 in 2024) plus IRA ($7,000) allows $30,000 in annual tax-advantaged investing.

Who Should Choose What?

Choose Starting a Business If You:

- Have specialized skills or industry expertise

- Thrive on challenges and problem-solving

- Want control over your financial destiny

- Can handle uncertainty and irregular income

- Have adequate capital reserves (6–12 months of expenses)

- Are you willing to sacrifice work-life balance temporarily

- Have identified a genuine market need

Choose Investing in Stocks If You:

- Prefer stable employment income

- Value lifestyle flexibility and free time

- Want passive wealth accumulation

- Have low to moderate risk tolerance

- Lack of business experience or specific expertise

- Want diversification across industries and markets

- Are starting with limited capital ($1,000–$10,000)

Best for Beginners:

Investing in stocks presents a lower-risk entry point for wealth building. Starting a business without experience, capital, and industry knowledge dramatically increases failure probability. Conversely, stock investing through low-cost index funds requires minimal knowledge and has proven remarkably effective over decades.

Can You Do Both? (Hybrid Approach)

The most sophisticated wealth-builders don’t choose one path—they pursue both strategically.

Using Stock Investments to Fund a Business:

Build a substantial investment portfolio while employed, generating passive income and appreciation. Once your portfolio reaches $100,000–$250,000, use the accumulated capital and ongoing investment returns as a financial cushion for starting a business. This approach provides security while pursuing entrepreneurial ambitions.

Diversifying Income Streams:

Many successful entrepreneurs invest business profits into stocks, creating diversification. If the business struggles, investment income provides stability. If the business thrives, investment growth compounds wealth further.

Real-world example: A software consultant builds a $300,000 investment portfolio over 10 years while earning $100,000 annually. She then launches a SaaS product, knowing her investments generate $20,000–$30,000 annually in passive income and can be liquidated if needed. The business eventually generates $200,000 yearly, which she partially reinvests into stocks, creating a virtuous cycle of wealth accumulation.

| Strategy | Starting Capital | Timeline | Risk Level | Potential Outcome |

|---|---|---|---|---|

| Stocks First | $5,000–$50,000 | 5–10 years | Low | $100,000–$500,000 portfolio |

| Business First | $10,000–$100,000 | 3–5 years | High | $0–$1,000,000+ business value |

| Hybrid Approach | $50,000+ total | 10+ years | Moderate | Diversified wealth across both |

Final Verdict

There’s no universal “better” choice between starting a business and investing in stocks—only the right choice for your specific circumstances, skills, and goals.

Key Takeaways:

- Accessibility: Investing in stocks requires minimal capital and expertise; starting a business demands substantial commitment on both fronts

- Risk-Return: Businesses offer unlimited upside with commensurate risk; stocks provide more predictable, moderate returns with lower failure risk

- Time Commitment: Business ownership consumes 50–70 hours weekly; stock investing requires 1–10 hours monthly

- Liquidity: Stocks can be sold within days; businesses take months or years to sell

- Best Strategy: For most people, start investing in stocks immediately while building skills and capital for potential business ventures later

Actionable Advice:

If you’re unsure, begin investing in stocks today through a low-cost index fund. Even $100 monthly starts building wealth and developing investing discipline. Simultaneously, explore business ideas through side projects, requiring minimal capital commitment. This approach preserves optionality while making progress on both fronts.

The wealthiest individuals typically build businesses AND invest in stocks, leveraging the unique advantages of each. Rather than choosing permanently, think of this as a phased approach: invest consistently while employed, potentially launch a business when circumstances align, and diversify across both assets throughout your wealth-building journey.

Your financial future doesn’t require choosing one path exclusively—it requires understanding both deeply and strategically deploying your resources where they’ll generate the greatest returns for your unique situation.

Frequently Asked Questions

Q. How much money do I need to start investing in stocks vs. starting a business?

- You can begin investing in stocks with as little as $1 through fractional shares, though $1,000–$5,000 provides a more meaningful start for building a diversified portfolio. Starting a business typically requires $10,000–$50,000 for most small ventures, though service-based businesses might start with $500–$2,000. The capital difference makes stock investing far more accessible for beginners with limited funds.

Q. Which option is less risky: starting a business or investing in stocks?

- Investing in stocks is generally less risky when properly diversified. About 50% of businesses fail within five years, while a diversified stock portfolio has never produced a negative return over any 20-year period in market history. However, businesses offer control over outcomes, while stock investors are passive observers. Your risk tolerance and desire for control should guide this decision.

Q. Can I invest in stocks while running a business simultaneously?

- Absolutely, and this hybrid approach is highly recommended for wealth diversification. Many successful entrepreneurs invest business profits into stock portfolios, creating multiple income streams and reducing dependence on business success alone. This strategy provides financial security while maximizing growth potential across different asset classes.

Q. How long does it take to see significant returns from each option?

- Stock investing typically shows meaningful results over 10–30 years through compound growth, with average annual returns of 7–10%. Businesses can generate significant returns much faster—within 2–5 years if successful—but carry a higher failure risk. Quick business success is possible but not guaranteed, while stock market returns are more predictable over extended periods.

Q. What skills do I need for starting a business vs. investing in stocks?

- Starting a business requires industry expertise, sales ability, financial management, leadership skills, and problem-solving capabilities. Investing in stocks requires basic financial literacy, discipline, and patience—skills anyone can develop. For passive investing through index funds, you need minimal expertise beyond understanding basic investment principles. This makes stock investing more accessible for people without specialized business skills.

Owner of Paisewaise

I’m a friendly finance expert who helps people manage money wisely. I explain budgeting, earning, and investing in a clear, easy-to-understand way.

I appreciate your ability to elucidate complicated concepts into accessible segments.

Pingback: The Small Business Loan Guide (Without Losing Your Mind)

I was recommended this website by my cousin. I am not sure whether this post is written by him as nobody else know such detailed about my difficulty. You are amazing! Thanks!