Table of Contents

ToggleWhat Is an ATM? A Complete Guide to Automated Teller Machines

Imagine needing cash at midnight or wanting to check your bank balance on a Sunday morning. A few decades ago, you’d have to wait until the bank opened. Today, you simply walk up to an ATM and complete your transaction in seconds. Understanding what is an ATM shows how Automated Teller Machines have revolutionized the way we access our money, offering 24/7 banking services at our fingertips.

In this comprehensive guide, we’ll explore everything you need to know about ATMs—from their history and how they work to safety tips and what the future holds for these essential banking machines—helping you understand what is an ATM and how to use it confidently.

What Is an ATM?

ATM stands for Automated Teller Machine—a computerized device that allows bank customers to perform financial transactions without needing a human teller. Understanding what is an ATM helps you see it as a mini-bank branch that never closes, accessible with just your debit or credit card and a personal identification number (PIN).

The ATM meaning goes beyond just cash withdrawal. These machines serve as self-service banking kiosks where you can check your account balance, transfer funds, deposit money, pay bills, and even recharge your mobile phone—all without stepping into a bank branch. Knowing what is an ATM and its purpose highlights how it provides convenient, round-the-clock access to accounts while reducing the workload on bank staff and branches. ATMs have become so integral to modern banking that it’s hard to imagine life without them.

History of ATMs

The ATM has an interesting origin story. The world’s first ATM was installed on June 27, 1967, at a Barclays Bank branch in Enfield, London. The inventor, John Shepherd-Barron, came up with the idea while taking a bath, frustrated that he couldn’t access his money because the bank was closed.

However, there’s some debate about who truly invented the ATM. American inventor Don Wetzel developed a different ATM model and received a U.S. patent in 1973. Meanwhile, Scottish inventor James Goodfellow patented the PIN technology used in ATMs in 1966.

Growth Timeline:

- 1967: First ATM installed in London

- 1969: First ATM in the United States (Chemical Bank, New York)

- 1970s: ATMs spread across major cities worldwide

- 1980s: Networked ATMs allowing interbank transactions

- Today: Over 3 million ATMs operating globally

How Does an ATM Work?

Understanding what is an ATM demystifies what seems like magic happening inside that metal box. Here’s a step-by-step breakdown of a typical ATM transaction:

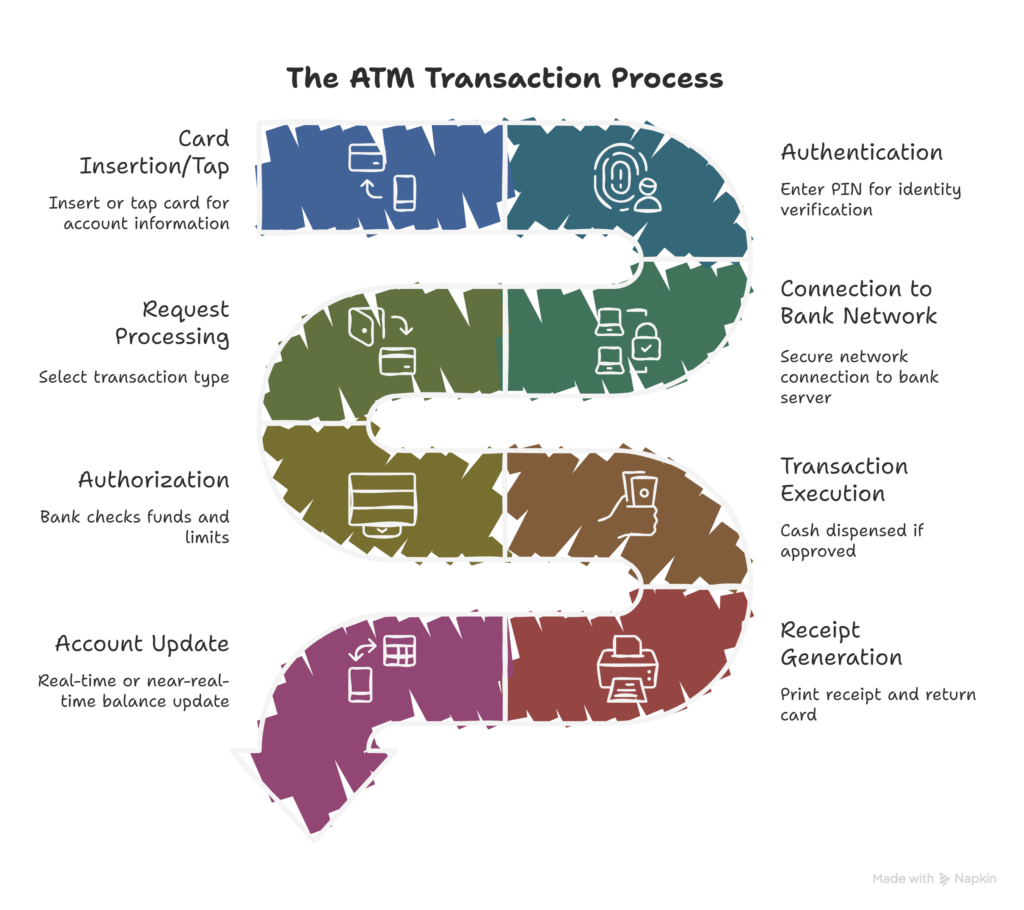

The ATM Transaction Process

- Card Insertion/Tap: You insert your debit or credit card into the card reader, or tap it for contactless transactions. The ATM reads the magnetic stripe or chip containing your account information.

- Authentication: You enter your PIN on the keypad. This is encrypted and sent to your bank’s server to verify your identity.

- Connection to Bank Network: The ATM connects to your bank’s server through secure networks (often using telephone lines, internet, or satellite connections). This happens in seconds.

- Request Processing: You select your desired transaction (withdrawal, balance inquiry, etc.). The ATM sends this request to your bank’s computer system.

- Authorization: Your bank’s server checks if you have sufficient funds and whether the transaction is allowed based on your account status and daily limits.

- Transaction Execution: If approved, the bank sends an authorization code back to the ATM. For cash withdrawals, the cash dispenser mechanism counts and releases the requested amount.

- Receipt Generation: The ATM prints a receipt (if you choose this option) showing transaction details, and your card is returned.

- Account Update: Your bank’s system updates your account balance in real-time or near-real-time.

The entire process typically takes less than a minute, thanks to sophisticated networking technology and bank server infrastructure.

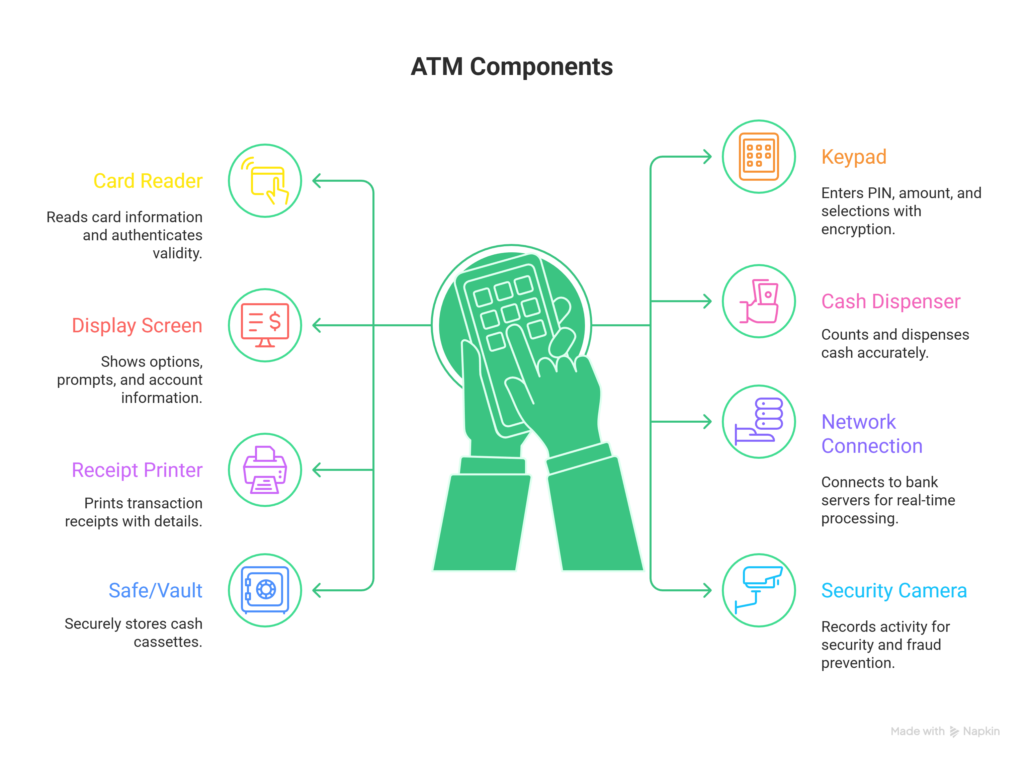

Main Components of an ATM

To understand what is an ATM, it helps to know that an ATM is a complex machine with several key components working together:

| Component | Function |

|---|---|

| Card Reader | Reads information from the magnetic stripe or chip on your card; authenticates card validity |

| Keypad | Allows you to enter your PIN, transaction amount, and make selections; includes encryption for security |

| Display Screen | Shows transaction options, prompts, and account information; often a touchscreen on modern ATMs |

| Cash Dispenser | Mechanical component that counts and dispenses the requested cash amount; includes sensors to ensure accuracy |

| Receipt Printer | Prints transaction receipts with date, time, amount, and remaining balance information |

| Network Connection | Connects the ATM to the bank’s servers via phone lines, internet, or satellite; enables real-time transaction processing |

| Safe/Vault | Secure compartment that stores cash cassettes; heavily reinforced and alarmed |

| Security Camera | Records all ATM activity for security and fraud prevention purposes |

Modern ATMs may also include additional features like deposit scanners for check and cash deposits, biometric readers for fingerprint authentication, and speakers for audio guidance.

Types of ATMs

To fully understand what is an ATM, it’s important to know that not all ATMs are created equal. There are several types of ATMs serving different purposes:

Bank ATMs

These are owned and operated by banks and are typically located at bank branches or in close proximity. They usually offer the most comprehensive services and are free to use for the bank’s customers.

White-Label ATMs

White-label ATMs are owned and operated by non-banking companies but provide banking services. These third-party operators are authorized by banks and typically charge transaction fees. You’ll often find these at gas stations, convenience stores, and shopping malls.

Bank ATM vs White-Label ATM Comparison:

| Feature | Bank ATM | White-Label ATM |

|---|---|---|

| Ownership | Owned by banks | Owned by non-bank entities |

| Location | Bank branches, prime locations | Retail stores, gas stations, remote areas |

| Fees for Own Bank Customers | Usually free (up to limit) | Transaction fees typically apply |

| Services | Full range (deposits, transfers, etc.) | Usually limited to withdrawals and balance inquiry |

| Maintenance | Bank-maintained | Third-party maintained |

On-Site vs Off-Site ATMs

- On-site ATMs: Located at bank branch premises, offering full banking services

- Off-site ATMs: Located away from bank branches in public spaces, malls, airports, etc.

Smart ATMs and Cash Recycler Machines

Smart ATMs represent the latest generation of these machines, offering:

- Cash and check deposit capabilities

- Advanced biometric authentication

- Video banking with live tellers

- Cardless transactions using QR codes or mobile apps

Cash recycler machines accept deposits and immediately make those bills available for withdrawal, improving efficiency and reducing the need for cash replenishment.

Services Offered by an ATM

Understanding what is an ATM today shows that modern ATMs are multifunctional banking kiosks. Here’s what you can typically do:

Cash Withdrawal

The most common ATM service—withdraw cash from your checking or savings account instantly. Subject to daily withdrawal limits set by your bank.

Balance Inquiry

Check your current account balance without going to the bank or logging into online banking.

Mini Statement

Print a summary of your recent transactions (usually the last 5-10 transactions) to track spending.

Cash Deposit

Many modern ATMs accept cash deposits, which are typically credited to your account within 24 hours. Some smart ATMs offer instant credit.

Fund Transfer

Transfer money between your own accounts (checking to savings) or to other accounts within the same bank.

Bill Payments and Mobile Recharge

Pay utility bills, credit card bills, or recharge mobile phones directly from the ATM.

Additional Services at Select ATMs:

- Check deposits

- Change PIN

- Request checkbook

- Print tax forms

- Purchase stamps or prepaid cards

- Foreign currency exchange (at some international ATMs)

ATM Fees and Charges

Understanding what is an ATM also means knowing about ATM fees in the U.S., which can help you avoid unnecessary charges. Here’s what you need to know:

ATM Withdrawal Limits

Most banks impose daily withdrawal limits to protect against fraud and manage cash flow. In the United States, typical ATM withdrawal limits range from $300 to $1,500 per day, though this varies by bank and account type.

Common Daily Withdrawal Limits by Bank Type:

| Bank Category | Typical Daily Limit |

|---|---|

| Major National Banks | $500 – $3,000 |

| Regional Banks | $500 – $2500 |

| Credit Unions | $300 – $1000 |

| Premium/Private Banking | $1,500 – $5,000 |

You can usually request a temporary limit increase by contacting your bank.

Free vs Paid ATM Transactions

Free Transactions:

- Using your bank’s own ATMs (most banks offer 3-5 free transactions per month at their ATMs)

- ATMs within your bank’s network or partner networks

- Some checking accounts offer unlimited free ATM usage

Paid Transactions:

- Using out-of-network ATMs (typically $4.86 on average)

- International ATM usage ($5+ per transaction)

- After exceeding your monthly free transaction limit

Interbank ATM Charges

When you use an ATM that doesn’t belong to your bank, you might face two fees:

- ATM operator fee: Charged by the ATM owner ($2-$4)

- Foreign ATM fee: Charged by your own bank ($1-$3)

This means a single out-of-network withdrawal could cost you $3-$7 in fees alone.

International ATM Usage Fees

Using ATMs abroad typically incurs:

- Foreign transaction fees (1-3% of withdrawal amount)

- International ATM fees ($5+ per transaction)

- Currency conversion markups

Pro Tip: Many online banks and some credit unions reimburse ATM fees, making them excellent choices for frequent travelers.

ATM Safety and Security

Understanding what is an ATM also highlights why ATM safety is crucial in today’s world. Here’s how to protect yourself:

Importance of Your ATM PIN

Your Personal Identification Number (PIN) is your first line of defense. It should be:

- Unique: Don’t use obvious numbers like birthdays or “1234”

- Memorized: Never write it down or store it with your card

- Private: Never share it with anyone, including family members

- Changed regularly: Update your PIN every few months

Common ATM Frauds

1. Skimming Criminals install devices on ATMs to capture your card information and PIN. The data is then used to create counterfeit cards.

2. Shoulder Surfing Fraudsters watch over your shoulder or use cameras to steal your PIN as you enter it.

3. Card Trapping A device is placed in the card slot to trap your card. When you walk away, the criminal retrieves your card.

4. Cash Trapping Devices block cash from being dispensed to you, which the criminal then retrieves after you leave.

5. Phishing and Fake ATMs Criminals set up fake ATMs or place realistic-looking overlays on real machines to steal card information.

ATM Safety Tips

Following these essential ATM safety tips can protect you from fraud:

Before Using the ATM:

- Choose well-lit, busy locations, especially at night

- Inspect the ATM for suspicious devices or loose parts

- Check the card slot and keypad for anything unusual

- Trust your instincts—if something feels wrong, use a different ATM

During Your Transaction:

- Shield the keypad with your hand when entering your PIN

- Stand close to the ATM to block others’ view

- Don’t accept help from strangers

- Be aware of people loitering nearby

- Don’t count cash at the machine

After Your Transaction:

- Take your card and receipt immediately

- Put cash away before leaving the ATM

- Check your account regularly for unauthorized transactions

- Report lost or stolen cards immediately

Advantages and Disadvantages of ATMs

Like any technology, understanding what is an ATM means recognizing that ATMs have both benefits and drawbacks.

Advantages

24/7 Access to Cash The biggest advantage is round-the-clock availability. Whether it’s 3 AM or a holiday, ATMs are always open for business.

Convenience No need to wait in line at the bank or adjust your schedule to banking hours. ATMs are located almost everywhere—shopping centers, airports, gas stations, and more.

Reduced Bank Branch Dependency Simple transactions can be completed at ATMs, freeing up bank staff for more complex customer needs and reducing branch congestion.

Additional Benefits:

- Quick transactions (usually under 2 minutes)

- Available in multiple languages

- Privacy for banking transactions

- Wide geographic coverage

- Multiple banking services beyond cash withdrawal

Disadvantages

Transaction Limits Daily withdrawal limits can be frustrating when you need larger amounts of cash, requiring multiple trips or branch visits.

Fees Out-of-network ATM usage can be expensive, with combined fees reaching $7 or more per transaction in some cases.

Risk of Fraud or Technical Failure ATMs are vulnerable to skimming, hacking, and technical malfunctions that can leave customers without access to their money.

Other Drawbacks:

- Limited denominations (usually only $20 bills in the U.S.)

- Cannot handle complex banking needs

- Machine may run out of cash

- Difficult for people with certain disabilities

- Lack of personal interaction and financial advice

What to Do If an ATM Transaction Fails

Understanding what is an ATM can help you prepare for situations where ATM transaction failures happen more often than you might think. Here’s what to do when cash isn’t dispensed but the amount is debited from your account:

Immediate Steps

- Don’t Leave Immediately: Stay at the ATM for a moment to see if the cash dispenses late (sometimes there’s a delay).

- Take the Receipt: This is crucial evidence of the failed transaction. If the ATM doesn’t print one, photograph the screen showing the error.

- Note Details: Write down:

- ATM location and ID number

- Date and exact time of transaction

- Amount debited

- Transaction reference number

- Error message displayed

- Check ATM Surroundings: Look for any obstruction or device that might have trapped your cash.

Filing a Complaint

Contact Your Bank:

- Call customer service immediately (number on your card)

- Visit your branch the next business day

- Use mobile banking app to report the issue

File a Written Complaint: Most banks require formal documentation. Include:

- Your account details

- Transaction receipt or screenshot

- Detailed description of what happened

- Any supporting evidence

Expected Refund Timeline

According to banking regulations in the United States:

- Provisional credit: Banks typically credit your account within 1-3 business days for investigation

- Final resolution: Complete investigation takes 10 business days for ATM transactions within the U.S., up to 45 days for international or complex cases

- Permanent credit: If the bank confirms the error, the provisional credit becomes permanent

Important: Your bank may require you to sign an affidavit confirming the transaction failure. Providing false information is fraud and carries serious consequences.

Pro Tip: Most failed ATM transactions are resolved in your favor as banks reconcile their ATM cash with transaction records daily. If the ATM shows a cash shortage matching your claim, you’ll receive your refund quickly.

Future of ATMs

Despite predictions of their demise, understanding what is an ATM shows that ATMs are evolving rather than disappearing. Here’s what the future holds:

Role in Digital and Cashless Economies

While digital payments are growing, cash remains important for:

- Populations without bank accounts or smartphones

- Small businesses preferring cash

- Emergency backup when digital systems fail

- Privacy-conscious consumers

ATMs are adapting by becoming multifunctional banking hubs rather than just cash dispensers.

Biometric ATMs

Next-generation ATMs use biometric authentication:

- Fingerprint scanning: Replace or supplement PIN entry

- Iris/retinal scanning: Highest security level

- Facial recognition: Contactless authentication

- Voice recognition: For accessibility and security

These technologies enhance security while making transactions faster and more convenient.

Cardless ATM Withdrawals

Modern ATMs allow cardless transactions using:

- QR codes: Generated through mobile banking apps

- NFC technology: Tap your smartphone instead of inserting a card

- One-time codes: Sent via SMS for secure access

This reduces fraud risk from skimming and eliminates the need to carry cards.

Integration with Mobile Banking

The future ATM is a seamless extension of your mobile banking app:

- Pre-stage transactions on your phone, complete at ATM

- Receive notifications when approaching an ATM

- Schedule cash pickups in advance

- Video teller services for complex transactions

Emerging ATM Technologies:

- Cryptocurrency ATMs: Buy and sell digital currencies

- Recycling machines: Accept deposits and immediately reuse cash for withdrawals

- Interactive screens: Video banking with human tellers

- Sustainable ATMs: Solar-powered, energy-efficient designs

Frequently Asked Questions About ATMs

Q. Is ATM money safe?

- Yes, ATM money is safe. Understanding what is an ATM helps you see that the bills dispensed are genuine currency, counted and verified by sophisticated machines. Banks regularly audit and replenish ATMs, ensuring the cash is legitimate. However, knowing what is an ATM also means using it safely—choosing secure locations and protecting your PIN is your responsibility.

Q. Can ATMs run out of cash?

- Absolutely. Understanding what is an ATM helps you know that ATMs have a limited cash capacity and can run out, especially during holidays, weekends, or in high-traffic locations. When an ATM runs out of cash, it typically displays an “Out of Service” message. Banks use monitoring systems to predict when refills are needed, but timing isn’t always perfect. Knowing what is an ATM also reminds you to plan withdrawals in advance to avoid inconvenience.

Q. How many times can you use an ATM per day?

- There’s typically no limit on the number of ATM transactions per day, but understanding what is an ATM helps you know that withdrawal amounts are often restricted. You might be able to make multiple $100 withdrawals throughout the day until you reach your daily limit (commonly $300–$1,000). Some banks also limit the number of free transactions per month, after which fees may apply. Knowing what is an ATM can help you plan your withdrawals wisely and avoid unnecessary charges.

Q. Are ATMs going to disappear?

- No, ATMs aren’t disappearing anytime soon, but understanding what is an ATM shows that they are evolving. While digital payments are growing, cash remains essential for millions of people. The number of ATMs in the U.S. has remained relatively stable at around 470,000 machines. Rather than disappearing, knowing what is an ATM helps you see how these machines are transforming into sophisticated banking kiosks offering services beyond simple cash withdrawal.

Q. Can I use any ATM with my debit card?

- You can use your debit card at most ATMs, but understanding what is an ATM helps you avoid surprises when using out-of-network machines (those not owned by your bank), which usually incur fees from both the ATM operator and your bank. Look for ATMs displaying your bank’s logo or the logos of partner networks to reduce or avoid these charges. Knowing what is an ATM and how it connects to your bank account makes it easier to choose the right ATM and minimize fees.

Conclusion

Automated Teller Machines have transformed from simple cash dispensers into sophisticated banking hubs that serve millions of people daily. Understanding what is an ATM, how it works, and how to use it safely empowers you to take full advantage of this convenient technology while protecting yourself from fraud.

From their invention in 1967 to today’s biometric and cardless machines, ATMs have continuously evolved to meet changing consumer needs. As we move toward an increasingly digital future, knowing what is an ATM in the modern banking landscape makes it clear that ATMs won’t disappear—they’ll adapt, offering new services while continuing to provide the reliability and accessibility that have made them indispensable. Ultimately, understanding what is an ATM helps consumers confidently navigate both today’s banking systems and the innovations of tomorrow.

Key Takeaways:

- ATMs provide 24/7 access to banking services beyond just cash withdrawal

- Always protect your PIN and remain vigilant about ATM safety

- Understand your bank’s ATM fees and withdrawal limits to avoid surprises

- If a transaction fails, act quickly and keep all documentation

- The future of ATMs includes biometric security, cardless transactions, and mobile integration

Whether you’re withdrawing cash for everyday expenses, checking your balance before a purchase, or depositing a check on a Sunday afternoon, ATMs continue to play a vital role in modern banking. By following the safety tips and best practices outlined in this guide, you can use ATMs confidently and efficiently.

Remember: ATMs are tools designed to make your financial life easier. Use them wisely, stay alert, and they’ll serve you well for years to come.

Owner of Paisewaise

I’m a friendly finance expert who helps people manage money wisely. I explain budgeting, earning, and investing in a clear, easy-to-understand way.

I love how your posts always leave me motivated and excited.

The very root of your writing whilst appearing agreeable initially, did not settle perfectly with me personally after some time. Somewhere within the sentences you were able to make me a believer but only for a short while. I however have got a problem with your jumps in assumptions and one would do well to help fill in those gaps. In the event that you actually can accomplish that, I would undoubtedly be impressed.

Pingback: How Savings Account Withdrawal Limits Work